additional tax assessed meaning

Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan. Hi my name is welcome to Just Answer.

You understated your income by more that 25 When a taxpayer under reports his or her gross income by more than 25 the three-year statute of limitations is increased to six years.

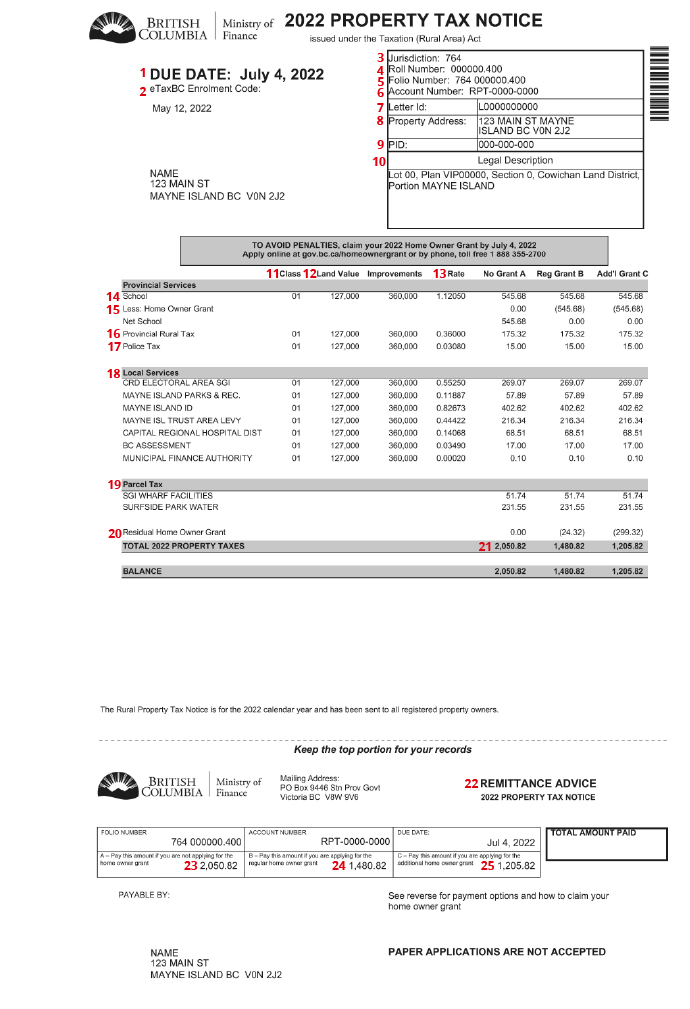

. The property tax rate also called a multiplier or mill rate is a percentage expressed in decimal form by which the assessed value of your property is multiplied to determine your tax bill. This entry was posted in Tax QA and tagged Audit. Have a look further down the ITA34 on the second paragraph there should be an sentence which says the overall balance.

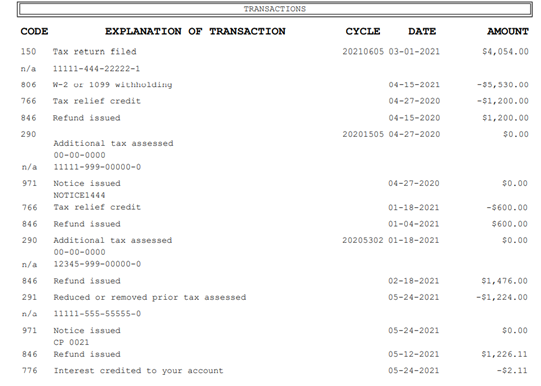

TC 290 with zero amount or TC 29X with a Priority Code 1 will post to a Lfreeze module. All the returns with NO issues is being updated in batches to be sent to the Master File Tape today to release the Refunds. How long can the IRS assess additional tax.

Possibly you left income off your return that was reported to IRS. Code 290 is for Additional Tax Assessed. 23 July 2013 at 1015.

Tax is an amount of money that you have to pay to the government so that it can pay for. Lana Dolyna EA CTC. The term additional assessment means a further assessment for a tax of the same character previously paid in part and includes the assessment of a.

The number 14 is the IRS Cycle Week. Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you owe. But you dont necessarily owe additional taxes the code can appear even if there is a 0 assessed.

The IRS can assess additional tax at any time if it can prove the taxpayer filed a fraudulent return or failed to file a. Individual Master File IMF Audit Reconsideration is the process the IRS uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid or a tax credit was reversed. In determining if more than 25 has been omitted capital.

IRS technically did release the freeze code at 1201 am - to allow ALL the returns to run thru the check systems one final time. Here is what you need to know about the sample IRS tax transcript with the transaction code 290. February 6 2020 437 PM.

Approved means they are preparing to send your refund to your bank or directly to you in the mail. Generates assessment of interest if applicable TC 196. In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed.

In non-TEFRA cases the taxpayer is mailed a notification that a tax plus interest and additions and penalties if any is due and a demand for payment. As a general rule the IRS must assess additional tax and propose penalties no later than 3 years after either a tax return is filed or the returns due date whichever is later. Code 290 Additional Tax Assessed on transcript following filing in Jan.

Accessed means that the IRS is going through your tax return to make sure that everything is correct. It means that your return has passed the initial screening and at least for the moment has been accepted. Additional assessment is a redetermination of liability for a tax.

Why was additional tax assessed. If the amount is greater than 0. The following is an example of a case law which defines an additional assessment.

A month later I request a transcript and it gave me code 290 additional tax assessed on the same date I. Just wait a bit and you will receive a letter explaining the adjustmentThat 290 is just a notice of change. I was accepted 210 and no change or following messages on Transcript since.

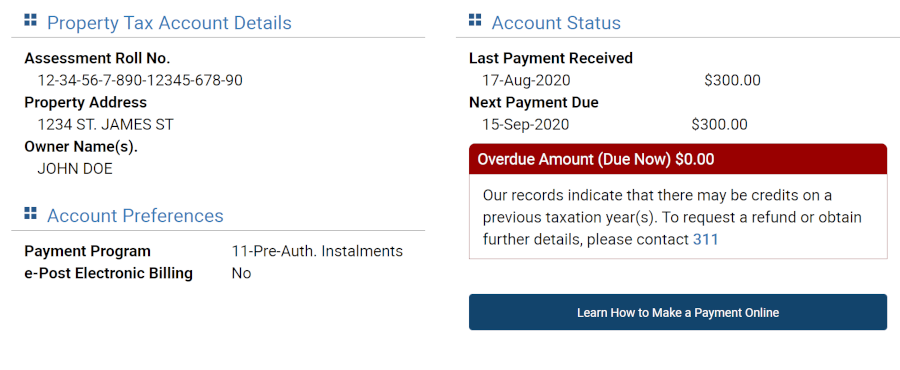

You can request Wage and Income Transcripts from IRS httpwwwirsgovIndividualsGet-Transcript and compare the numbers reported to IRS. The assessment is multiplied by the tax rate and that is how your annual tax bill is calculated. It may mean that your Return was selected for an audit review and at least for the date shown no additional tax was assessed.

For TEFRA cases see CCDM 359352. Additional tax as a result of an adjustment to a module which contains a TC 150 transaction. Just sitting in received.

For a detailed discussion of appeals see CCDM Part 36. Examination cases closed as Non-Examined with no additional tax assessed do not meet the definition and criteria of an Audit Reconsideration. The timing of an assessment after a decision is entered depends on whether an appeal is filed.

Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an Additional Assessment. I filed an injured spouse from and my account was adjusted. It may mean that your Return was selected for an audit review and at least for the date shown no additional tax was assessed.

Its a process that have to run its course it wont spit out 846 at 1201. If that occurs the IRS generally has 60 days from the receipt of the return to assess additional tax. A tax assessment is a number that is assigned by the taxing authority of your state county or municipality depending on where the property is located as the value of your property.

It is a further assessment for a tax of the same character previously paid in part. You may be reviewing your tax transcript and wondering why a Code 290 appears. The meaning of code 290 on the transcript is Additional Tax Assessed.

From the cycle 2020 is the year under review or tax filing. Tax Assessment means any assessment notice demand letter or other document generated or issued including the preparation of any return assessment or computation or action taken by or on behalf of any Taxation Authority from which it appears that any one or more of the Company any other Group Company or any member of the Buyer s Tax. Meaning pronunciation translations and examples.

The 20201403 on the transcript is the Cycle. This number is called your tax assessment. What does additional tax assessed 09254-587-08904-6 mean with a cycle date 20162705.

575 rows Additional tax assessed. They say all good things come to those who wait. All You Need to Know FAQs.

You can also request a statement of account from the SARS correspondence tab and click on historic IT notices to see your overall balance. This usually happens when SARS disallows some of your expenses and therefore issues an Additional Assessment showing the extra tax that is due.

Your Property Tax Assessment What Does It Mean

Your Tax Assessment Vs Property Tax What S The Difference

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Sample Rural Property Tax Notice Province Of British Columbia

Your Tax Assessment Vs Property Tax What S The Difference

Your Tax Assessment Vs Property Tax What S The Difference

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Secured Property Taxes Treasurer Tax Collector

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Your Tax Assessment Vs Property Tax What S The Difference

Your Tax Assessment Vs Property Tax What S The Difference

Your Tax Assessment Vs Property Tax What S The Difference

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

Your Property Tax Assessment What Does It Mean

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Toronto Property Tax 2021 Calculator Rates Wowa Ca

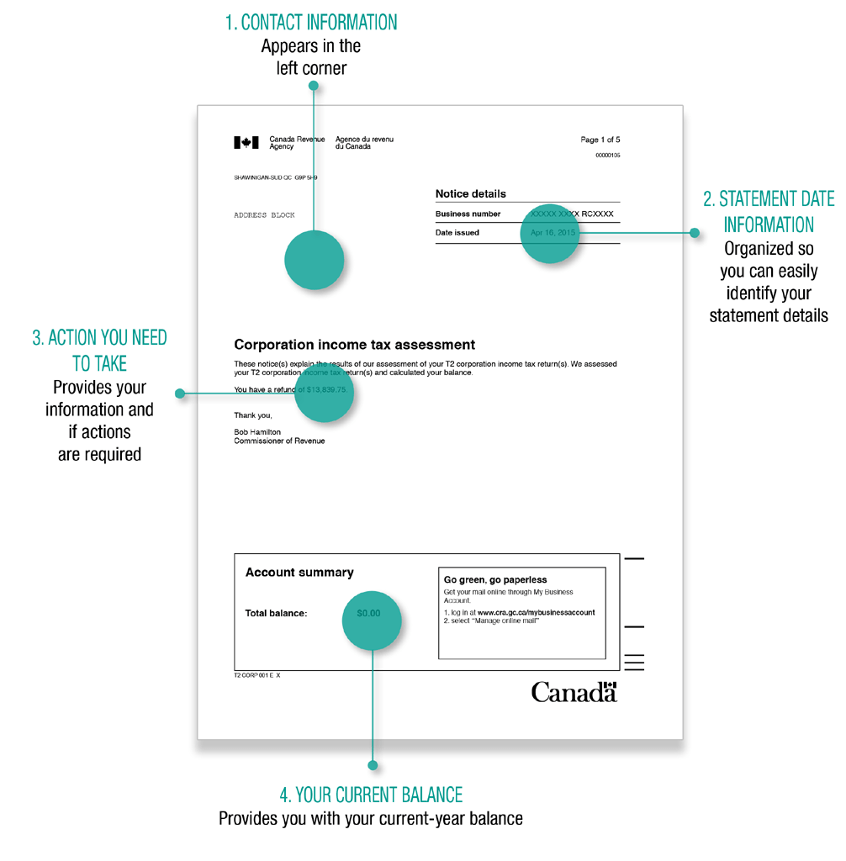

Notice Of Assessment Overview How To Get Cra Audits

Cra Notice Of Assessment Why It S Needed For Separation Divorce Fyi